- #1065 e file software for mac for free#

- #1065 e file software for mac pdf#

- #1065 e file software for mac software#

#1065 e file software for mac for free#

Adobe Reader can be downloaded for free from the Adobe website.

#1065 e file software for mac pdf#

To view and print completed tax returns, a current version of Adobe Reader or other PDF reader must be installed. In your browser settings cookies and JavaScript must be enabled. Supported browsers include: Internet Explorer (versions 9.0 and greater), Firefox (versions 1.5 and greater), Google Chrome (versions 1 and greater), Opera (versions 11 and greater), Netscape (versions 4.7 and greater), Microsoft Edge (versions 1 and greater), and other common Web browsers.

#1065 e file software for mac software#

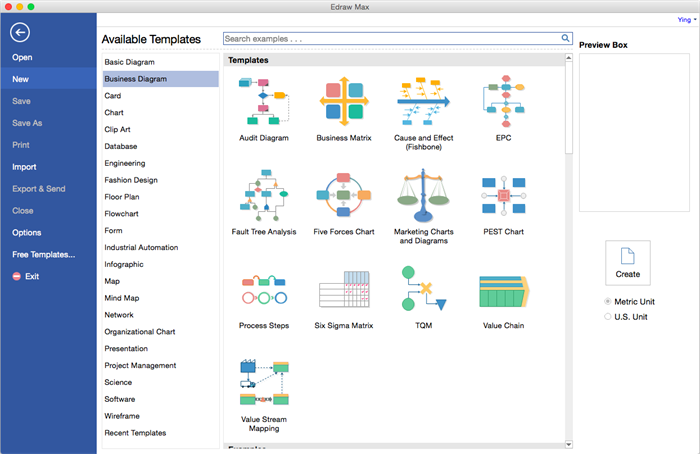

The online software requires an internet connection with a current Web browser installed. Please read through our Tax Questions & Answers for quick answers to your questions. Support/Help Online Tax Help to send questions to the support team.

Form TANF, Employer's Credit for Expenses Incurred for TANF (ADC) Recipients.Form NOL, NE Net Operating Loss Worksheet.Form NFC, Statement of NE Financial Institution Tax Credit.Form PTC, Nebraska Property Tax Incentive Act Credit Computation.The online software requires an internet connection with a current Web browser installed. Supported browsers include: Internet Explorer (versions 9.0 and greater), Firefox (versions 1.5 and greater), Google Chrome (versions 1 and greater), Opera (versions 11 and greater), Netscape (versions 4.7 and greater), Microsoft Edge (versions 1.0 and greater), and other common Web browsers. In your browser settings cookies and JavaScript must be enabled. Please read through our Service Details for more information. Support/Help our Web-based support form to send questions to the support team. Electronic Funds Withdrawal (EFW) Estimated Payments.Nebraska Schedule K-1N, Form 1120-SN, Form 1065N, or Form 1041N.

Form NOL, Nebraska Net Operating Loss Worksheet.Form NFC, Statement of Nebraska Financial Institution Tax Credit.Form CDN, Nebraska Community Development Assistance Act Credit Computation.Form 4797N, Special Capital Gains/Extraordinary Dividend Election and Computation.Form 3800N, Nebraska Incentives Credit Computation for Tax Years after 2005.Form 2210N, Individual Underpayment of Estimated Tax.Form 1310N, Statement of Person Claiming Refund Due a Deceased Taxpayer.Nebraska Schedule K-1N, Form 1120-SN, Form 1065N, Form 1041N.Form 1040N-EB, Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit.If you encounter any problems with product availability or state support, contact the software company, or choose another product. The Nebraska Department of Revenue does not endorse any software, recommend one software product over another, or monitor software products for continuous availability and state support. It is possible that, even if the software is approved, the product or company may not be ready to support filing Nebraska returns. Products listed below are in alphabetical order. File federal and state returns at Approved Commercial Online E-file Software for Tax Year 2020 MyFreeTaxes is a partnership between Goodwill Industries International, National Disability Institute, and United Way. Self-file includes free telephone, email, and online chat support. MyFreeTaxes provides 100% free federal and state tax return preparation and e-file for households with Adjusted Gross Income (AGI) of $69,000 or less in 2020.

0 kommentar(er)

0 kommentar(er)